June home sales rebound across Austin area; sales decline in first half of 2020 due to COVID-19

- jamesbrinkman

- Jul 31, 2020

- 4 min read

Austin Real Estate Update | August 2020 I truly hope this finds you healthy and in good spirits. Tesla announced that they are building the Terafactory in Austin a little over a week back. This continues the trend of the major industry leaders, such as Apple and Tesla, seeing Austin as a place of ingenuity, creativity, and good for business. Between those two employers we're looking at a potential 25,000 new jobs not to mention the multiplier impact for business that will serve those two companies. Please think of me should you or your friends/associates have any real estate needs or questions, I'm never too busy to help. This edition features the most recent market updates as well as Austin news and events - Enjoy!

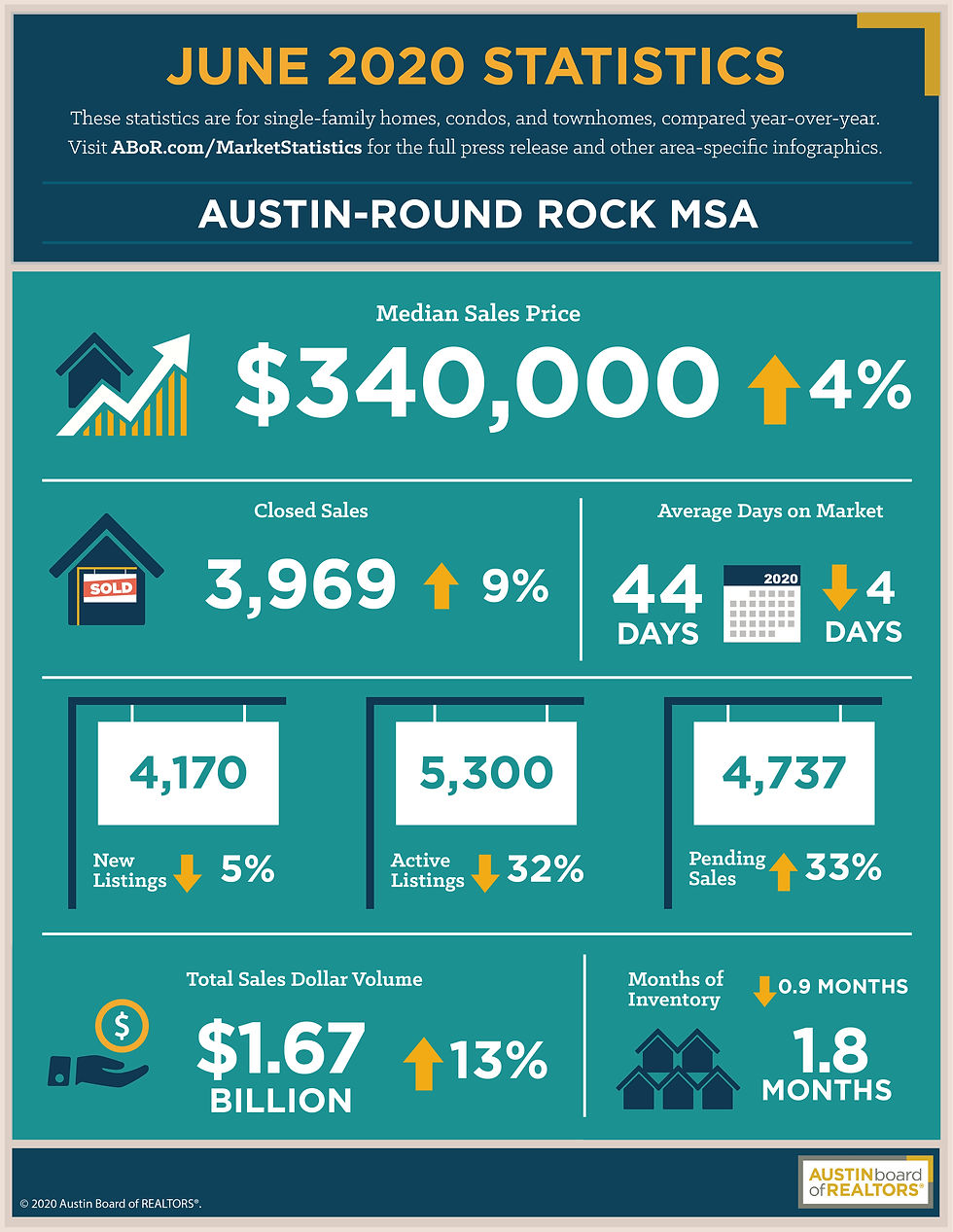

Home sales in the Austin-Round Rock Metropolitan Statistical Area (MSA) rebounded this June with a 9.3% increase year over year, which helped hold sales to only a 5.2% decline during the first half of 2020 as the market was impacted by COVID-19, according to the Austin Board of REALTORS® (ABoR) June and Midyear Central Texas Housing Market Report.

Across the five-county MSA in June, residential home sales increased 9.3% year over year to 3,969 sales, and the median price increased by 4.6% to $340,000. Sales dollar volume also increased 13.1% to $1,674,070,282 and pending sales increased by 33.7% to 4,737. Housing inventory declined 0.9 months to 1.8 months of inventory, demonstrating an extremely competitive and tight market across the region, even as it begins to show signs of improvement.

Personal take - The increase in sales in June helped to mitigate the overall impact of the pandemic on the sales statistics for first half of the year. July should show strong sales as well given the increase in pending sales in June. The challenge that we are facing now is something I addressed in last month's email: a lack of inventory. Properties that had even been on the market for long stretches sold and they aren't being replaced by new inventory. With the increase in cases in Texas in July, combined with the uncertainty of how school openings will go, I continue to remain cautious yet optimistic.

Despite an increase in pending sales, new listings dropped 5.4% to 4,170 listings, and active listings dropped 32.2% to 5,300 listings. James Gaines, chief economist for the Real Estate Center at Texas A&M University, thinks perspective is needed when interpreting the market throughout 2020. “There are plenty of unknowns in the months ahead, but June home sales across the MSA being up 9.3% YoY was tremendous when considering the strength of 2019. And while home sales declined throughout the Austin-MSA during the first six months of 2020, we are still on track for a strong year. Extremely low inventory is one of the factors that affects overall sales dollar volume while simultaneously creating a very competitive and tight market. Home builders aren’t building quite as many new homes and sellers were hesitant to list their home during shelter in place orders. Even if we end up with a 3 to 4% decline in sales in 2020, that would still be a strong year for the region.” In the Austin-Round Rock MSA in the first half of 2020, homes sales in the Austin-Round Rock MSA declined 5.2% year over year to 17,043 home sales. Sales dollar volume declined 1.9% to $6,897,765,107, while the median price increased 4.9% to $325,200. So far this year, new listings declined 7.5% to 22,744 new listings; active listings dropped 19.2% to 5,616 listings. However, pending sales slightly increased 2% to 20,389 pending sales. In the city of Austin, home sales in the first half of the year decreased 13.6% year over year to 5,291 sales, while the median price rose 9.7% to $406,000. At the same time, sales dollar volume decreased by 6.2% to $2,621,719,744. New listings dropped 9.7% to 7,498 listings; active listings declined 21.8% to 1,398 listings; and pending sales also fell 8.9% to 6,201 pending sales. At the county level, home sales decreased 10.3% year over year to 8,452 home sales in the first half of the year. During the same period, sales dollar volume dropped 6.5% to $4,078,268,052, as the median price rose by 7% to $385,000. New listings decreased 10.8% to 11,721 listings, and active listings dropped 24% to 2,572 listings. Pending sales also fell 5.3% to 9,976 pending sales. (information courtesy of ACTRIS)

Send a Referral National Market Update The V-shaped housing recovery continues. New Home Sales soared in June to a level higher than the one they reached before the shutdown--up 13.8% for the month, posting their highest annual sales rate since 2007. Existing Home Sales spiked 20.7% in June, their biggest monthly gain ever. Sales are still down 11.3% from a year ago, but demand is strong--62% of homes sold were on the market less than a month. Attom Data reports the typical home-sale profit hit $75,971 in the second quarter this year. That’s a 36.3% return on investment (ROI) from the original price for home sellers, a new post-recession high. In Freddie Mac's Primary Mortgage Market Survey, the national average 30-year fixed mortgage rate was up slightly from the prior week's record low. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up-to-the-minute information. No one sees the Fed touching rates this week, or any time before the economy fully returns to where it was before the shutdown.

Comments