Austin-Round Rock MSA Adds Housing Inventory as Home Builder Confidence Grows

- jamesbrinkman

- Jun 1, 2023

- 4 min read

The Austin-Round Rock MSA housing market is outperforming national trends while continuing to balance, according to the Austin Board of REALTORS® April 2023 Central Texas Housing Market Report. The most recent National Association of REALTORS® data (March 2023) found that home sales declined 22.7% nationally while in Central Texas, they declined 14%, demonstrating resilience of the region’s economy. Last month, Austin-Round Rock housing inventory increased 2.4 months to 3.2 months of inventory, and homes spent an average of 71 days on the market, up 53 days from April 2022. The median home price fell 15.1% to $466,705 while residential home sales also declined 18.8% year-over-year to 2,611 closed sales and sales dollar volume dropped 29.3% to $1,545,088,361. New listings declined 10.6% year-over-year to 4,115 listings while pending sales rose 0.2% to 3,267 transactions.

"For several months, the Austin-area housing market has been balancing as REALTORS® continue to help clients on both sides of the transaction navigate this market effectively,” Ashley Jackson, 2023 ABoR president, said. “This is still a market that is seeing lots of activity, just not at a record-setting pace, and that is to be expected given broader economic trends. Home prices are moderating, pending sales are holding strong and homes on the market last month are selling closer to list price. These are all signs of a market that is still balancing and doing so in a healthy way.” "Inflation, the near doubling of mortgage rates, fear of a recession, and, most recently, stress in the banking system have all contributed to declines in home prices nationally. In Austin, robust job and population growth have mitigated these effects on homebuyer demand, favorably indicating that our region’s economy and housing market continue to outperform national economic trends. Austin remains resilient and able to withstand broader economic turbulence more effectively.”

City of Austin In April, home sales decreased 31.0% to 740 sales, while sales dollar volume decreased 34.8% to $543,967,464. At the same time, median price decreased 11.4% to $565,000 for the City of Austin. Last month, new listings slightly decreased 0.6% to 1,359 listings, active listings skyrocketed 216.0% to 2,357 listings as pending sales declined by 9.9% to 949 pending sales. Monthly housing inventory increased 2.5 months year over year to 3.2 months of inventory.

Travis County In Travis County, home sales decreased 28.6% to 1,167 sales, while sales dollar volume dropped 34.9% to $839,004,026. Last month, the median price in Travis County dipped 13.3% year over year to $537,500, new listings decreased 7.7% to 2,047 listings and active listings ballooned 211.5% to 3,975 listings year over year. Pending sales declined 8.5% to 1,502 pending sales as monthly housing inventory increased 2.5 months year over year to 3.3 months of inventory.

Williamson County April home sales decreased 11.2% to 919 sales and sales dollar volume declined 22.2% year over year to $457,918,942 in Williamson County. The median price decreased 12.8% to $445,000 as new listings also decreased 19.8% to 1,247 listings. During the same period, active listings soared 178.0% to 2,346 listings while pending sales slightly rose 4.7% to 1,092 pending sales. Housing inventory rose 1.9 months to 2.6 months of inventory.

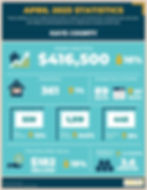

Hays County In Hays County, April home sales rose slightly 1.1% to 361 sales while sales dollar volume dropped 19.0% to $182,586,736. The median price for homes fell 16.9% to $416,500. During the same period, new listings decreased 12.2% to 520 listings, while active listings skyrocketed by 243.5% to 1,319 listings. Pending sales increased 8.5% to 445 pending sales as housing inventory jumped by 2.6 months to 3.6 months of inventory. (information courtesy of ACTRIS)

National Market Update The spring housing market is heating up. The Mortgage Bankers Association reports new-home purchase applications rose year-over-year for the third straight month. They note: “the broader housing market is leaning more on new construction to boost for-sale inventory.” The Mortgage Bankers Association reported purchase mortgage applications rose 5% compared to the week before. Even refinancing applications spiked 10% from the prior week. This is happening even as the National Association of Realtors reports that almost seven out of ten metros saw home prices rise the first three months of the year after roughly half a year of moderate price declines. April saw sales of new homes surge to a 13-month high, up 4.1% from March and 11.8% ahead of last year. Inventories have recently made substantial gains, and the median price is down 8.2% from a year ago. Housing Starts rose in April for both single- family and multi-unit projects. Starts are still down from a year ago, but building has hardly stopped, with the number of homes under construction near its highest level since 1970. With so many projects in the pipeline, builders are busy, so it was no surprise to see permits for new projects slip a tad in April. The NAHB builder sentiment index rose for the fifth straight month to its highest level since last July. Sales of existing homes slowed in April, thanks to a less than 3 months’ supply of homes for sale, versus the 5 months of a normal market. But good news for buyers came with the median price now down 1.7% from a year ago. Contract signings on existing homes were flat in April, although three of the four major U.S. regions saw monthly gains. Only the Northeast’s numbers decreased, pulling down the national average. A new Zillow study supports this, reporting home values climbed 1% from March to April, as buyer demand for limited inventory is re-igniting the sellers’ market. Higher rents are also bringing more buyers onto the scene. Wall Street expects another quarter percent rate hike in June. There could be a change in September, but opinion is divided between a hike and a cut. No less than four Fed members commented that the central bankers may not be done raising rates. One FOMC voter emphasized, "fighting inflation continues to be my priority." So, another hike may be coming, as the PCE Price Index, the Fed's favorite inflation measure, ticked up in April.

I look forward to staying in close contact with you. I'm always up for grabbing lunch and catching up so don't hesitate to reach out! If you know someone else who would benefit from my monthly newsletter, please feel free to forward and encourage subscription! Thank you so much. Stay Hopeful, Stay Positive - Brink